FOR INVESTORS

AltynGold Plc is committed to meeting best practice governance standards and this was further demonstrated with the Company's move to the Main Board of the London Stock Exchange in December 2014.

AltynGold Plc has been operating the Sekisovskoye mine since 2008. Initially, it was an open pit operation. Since 2017, all production is from higher-grade underground operations. The Competent Persons report completed in 2019 indicated proved reserves under the JORC 2012 classification of 3.47Moz and attractive gold grades 3.61 g/t.

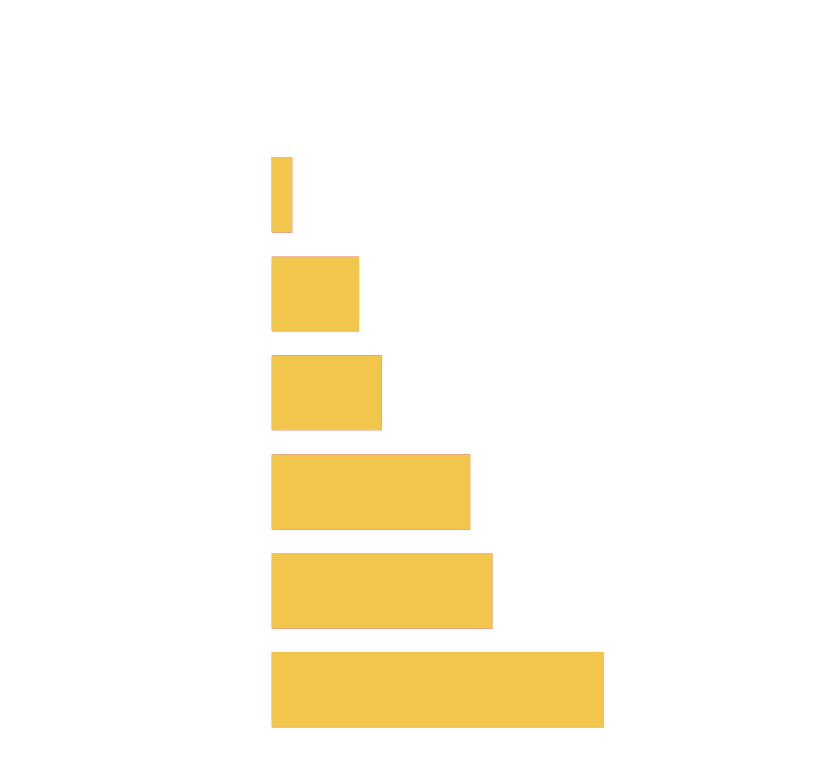

The Company's aim is to produce 100 thousand ounces of gold production under phase 1 of the underground development plan (from the current level down to -50masl depth). The Company is currently at -150masl under Phase 1of its development. Production should further ramp up towards 1mt target of processed ore over the next three years as the company boosts its mining equipment. Operations are expected to have a competitive cash costs of production aiming initially at between US$500-US$600 an oz.

The Company has sourced the capex required to bring the production on line as stated above. Phase 2 should boost production more as operations move further underground (from -50 to -400masl). Additionally, Teren-Sai has significant upside potential with one deposit and four defined Au exploration targets and an estimated exploration objective of Au 9Moz.

The Company's aim is to produce 100 thousand ounces of gold production under phase 1 of the underground development plan (from the current level down to -50masl depth). The Company is currently at -150masl under Phase 1of its development. Production should further ramp up towards 1mt target of processed ore over the next three years as the company boosts its mining equipment. Operations are expected to have a competitive cash costs of production aiming initially at between US$500-US$600 an oz.

The Company has sourced the capex required to bring the production on line as stated above. Phase 2 should boost production more as operations move further underground (from -50 to -400masl). Additionally, Teren-Sai has significant upside potential with one deposit and four defined Au exploration targets and an estimated exploration objective of Au 9Moz.

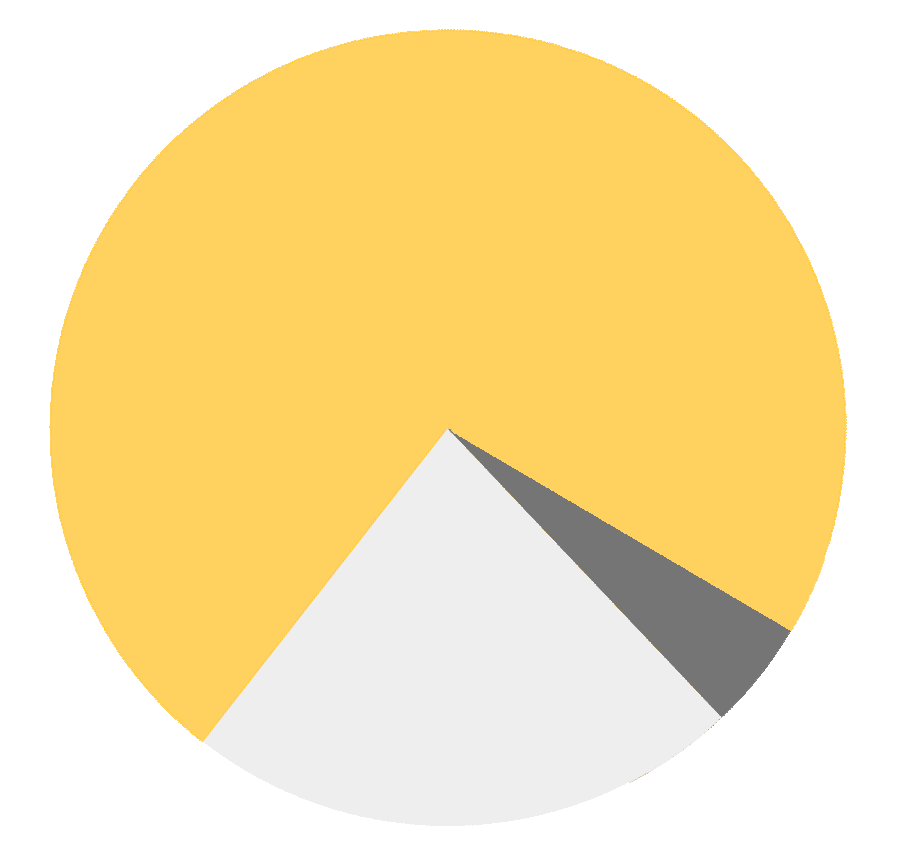

TOP SHAREHOLDERS

Freedom finance - 5.6%

INVESTMENT CASE

RETAIL/OTHERS

AFRICAN RESOURCES LIMITED

65.6%

28.8%

OF KAZAKHSTAN

ECONOMIC OVERVIEW

MINING INDUSTRY OVERVIEW

KAZAKHSTAN

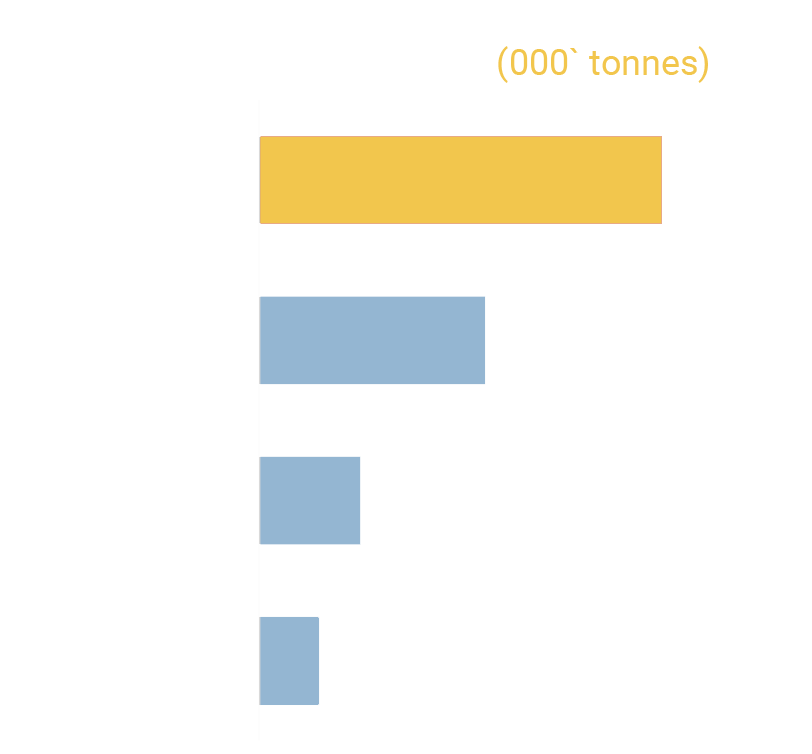

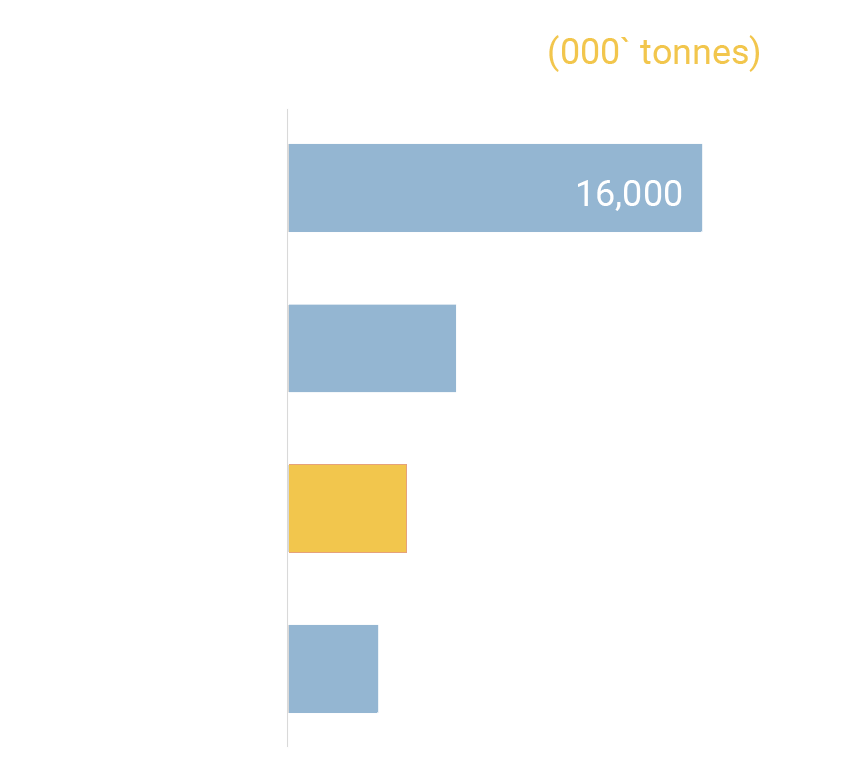

The mining sector is one of the most competitive and dynamically developing industries of Kazakhstan; the country has abundant natural resources, with ~100 elements discovered and 60 being actively recovered.

The mining sector is one of the most competitive and dynamically developing industries of Kazakhstan; the country has abundant natural resources, with ~100 elements discovered and 60 being actively recovered. The mining industry in

The mining industry in

Kazakhstan is expected to grow to US$30 billion by 2017, primarily driven by growth in the coal, gold, and copper sectors Approximately 80% of all mining products are exported to 30+ countries globally, representing 30% of the country's annual revenue

Approximately 80% of all mining products are exported to 30+ countries globally, representing 30% of the country's annual revenue National Bank of Kazakhstan has a priority right to purchase precious metals from miners

National Bank of Kazakhstan has a priority right to purchase precious metals from miners

~17%

1. Source: Kaznex Invest 2016 Report, Tradingeconomics.com, World Nuclear Association, USGS

of GDP and exports

contains mining products

contains mining products